Nonprofit Loans Placed

134,977,000

Amount Freed for Impact

11300000

Our Comprehensive Solution

We solve your loan needs with the most options of any service available.

By working with us you’ll lower your monthly payments, as much as 60%,

and together with your supporters make a bigger impact on the community you serve.

Our Comprehensive Solution

We solve your loan needs with the most options of any service available.

By working with us you’ll lower your monthly payments, as much as 60%,

and together with your supporters make a bigger impact on the community you serve.

Impact Stories

Stewarding Loans – Building Community

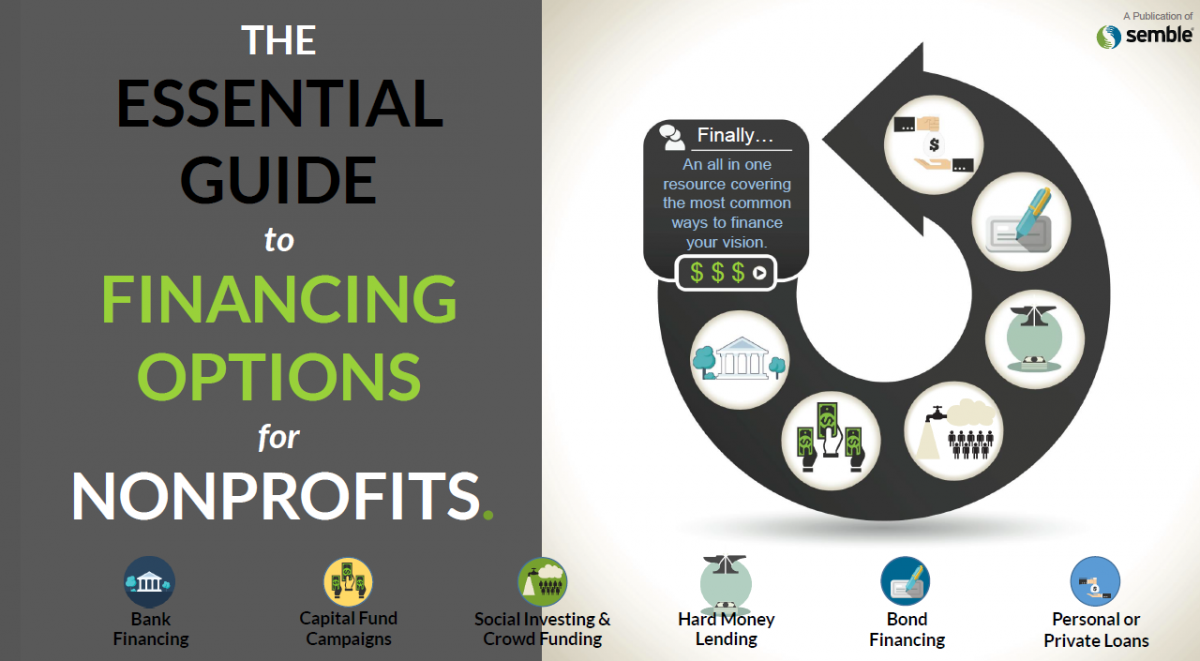

Don’t Limit Your Options

Semble can more effectively bring you options for your loan. Let us help you navigate.

For more comparisons download Semble’s complimentary pdf guide.

Download Nonprofit Finance Guide Now

Mission

Our transformative and proven approach to addressing loan needs for nonprofits and ministries is realizing great impact for nonprofits and the communities they serve as well as forging strengthened relationships with supporters by providing a way to direct investments towards mission. As a result, over $10 million has been freed to make a difference.

Find out how much further you can fuel your mission with Semble’s loan solutions.

Start now and calculate how much you can grow your impact